<aside> 💡 Welcome to Klavena’s help center! We're here to answer your questions.

Can't find what you're looking for? Send our support team a note at [email protected]!

</aside>

A Profit and Loss (P&L) statement, also known as an income statement, is a financial document that outlines a company's revenues and expenses over a specific period, typically a month, quarter, or fiscal year. It serves to assess a company's profitability by comparing its income against its expenses.

The formula for calculating profit or loss is Revenue - Expenses = Profit or Loss. This statement is crucial for business owners and investors to understand the financial health of a company, analyze performance, and make informed decisions.

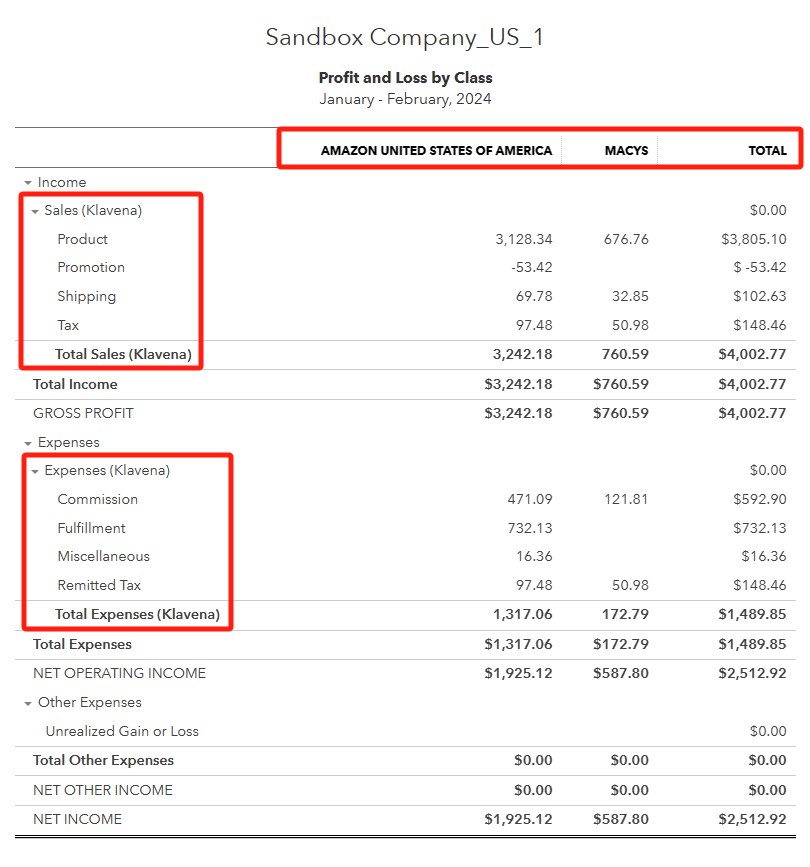

Klavena creates different income accounts to categorize the different types of income: product sales, tax, shipping, promotion, and other. Klavena then creates different expenses accounts to categorize the different types of expenses: remitted tax, commission, fulfillment, storage, advertising, and miscellaneous.

If you are using QuickBooks Online Plus or Advanced, look at the Profit and Loss by Class report. Else, look at the generic Profit and Loss report.

Here, you can see the breakdown of income and expenses into these categories, and also by sales channel. Note: the breakdown by class is only available in QuickBooks Online Plus or Advanced.

One item clearly missing in the above report is the Cost of Goods Sold (COGS). This is assuming that you are using the accrual method.

Even if you have created a purchase transaction in QuickBooks Online to buy your products, these will not show up in the profit and loss report.

This is because with the accrual method, the cost of goods is only calculated when the item is sold, and we haven't enabled inventory tracking to know when a certain inventory item is sold.

Please follow this tutorial to enable inventory tracking in Klavena and Quickbooks.

After you have setup inventory tracking, undo all your current settlements, and re-import the settlements so that the new QuickBooks transactions keep track of inventory.

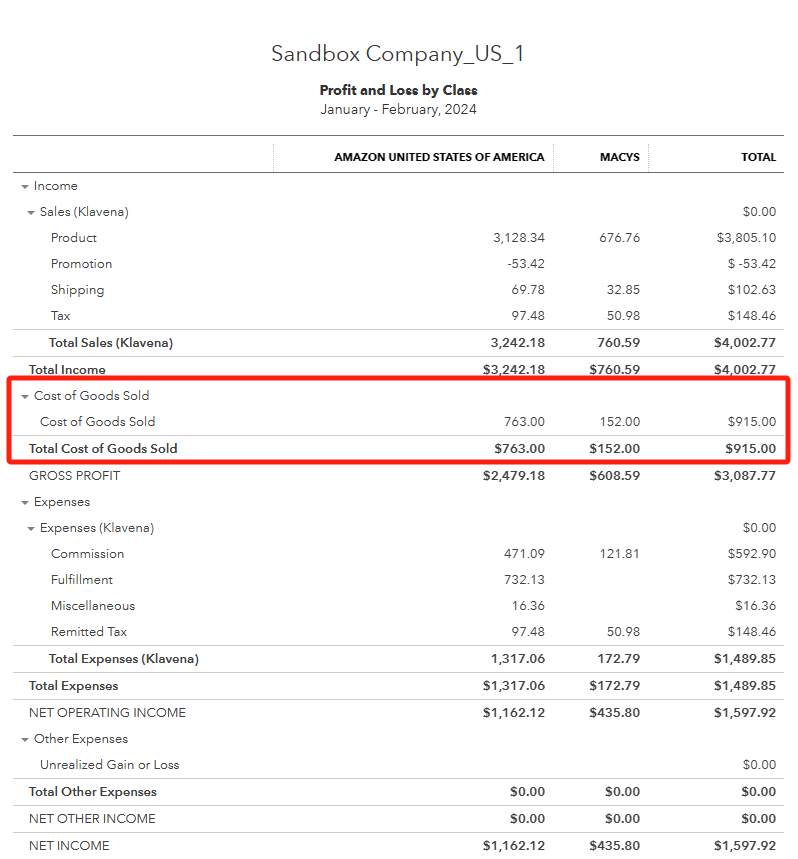

The new profit and loss report will look like this: