<aside> 💡 Welcome to Klavena’s help center! We're here to answer your questions.

Can't find what you're looking for? Send our support team a note at [email protected]!

</aside>

In this tutorial, we're going to go over how to manually do your bookkeeping for Amazon with QuickBooks Online without any apps or integrations. These are the steps Klavena performs automatically, so that you won’t have to do them.

By the end of this tutorial, you will have all of your Amazon transactions perfectly imported into QuickBooks Online with 100% accuracy to the penny. We introduce a CPA-approved method that all accountants should understand instantly. It should also make it easy to file taxes yourself if you choose to do so.

You'll be able to keep track of all of your sales, refunds, taxes, fees, etc. and view all of your business financial reports such as the Profit/Loss and Balance Sheet.

However, this does come with a few caveats, namely you will only import entire summaries at once, and you cannot use inventory tracking to calculate cost of goods sold automatically. Stay tuned till the end to learn about a software that helps you do all this automatically and more!

First, we need to set up QuickBooks Online properly. There are many QuickBooks objects to set up here involving the chart of accounts, customers, vendors, and items. Please pay attention carefully.

In QuickBooks Online, you likely already have a business savings account or checking account where you deposit all of your Amazon payouts. Make sure you have this bank account setup and all its transactions synced with QuickBooks.

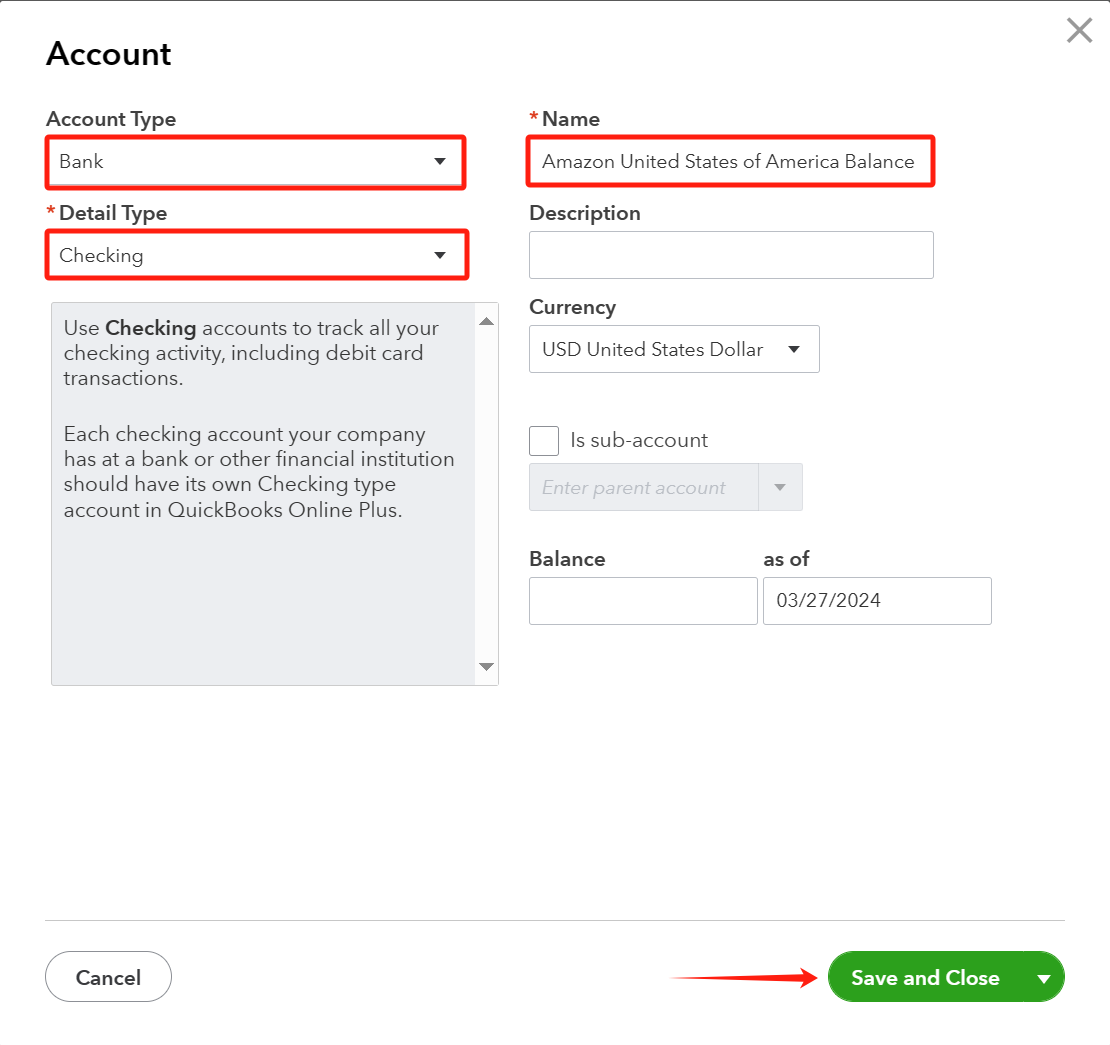

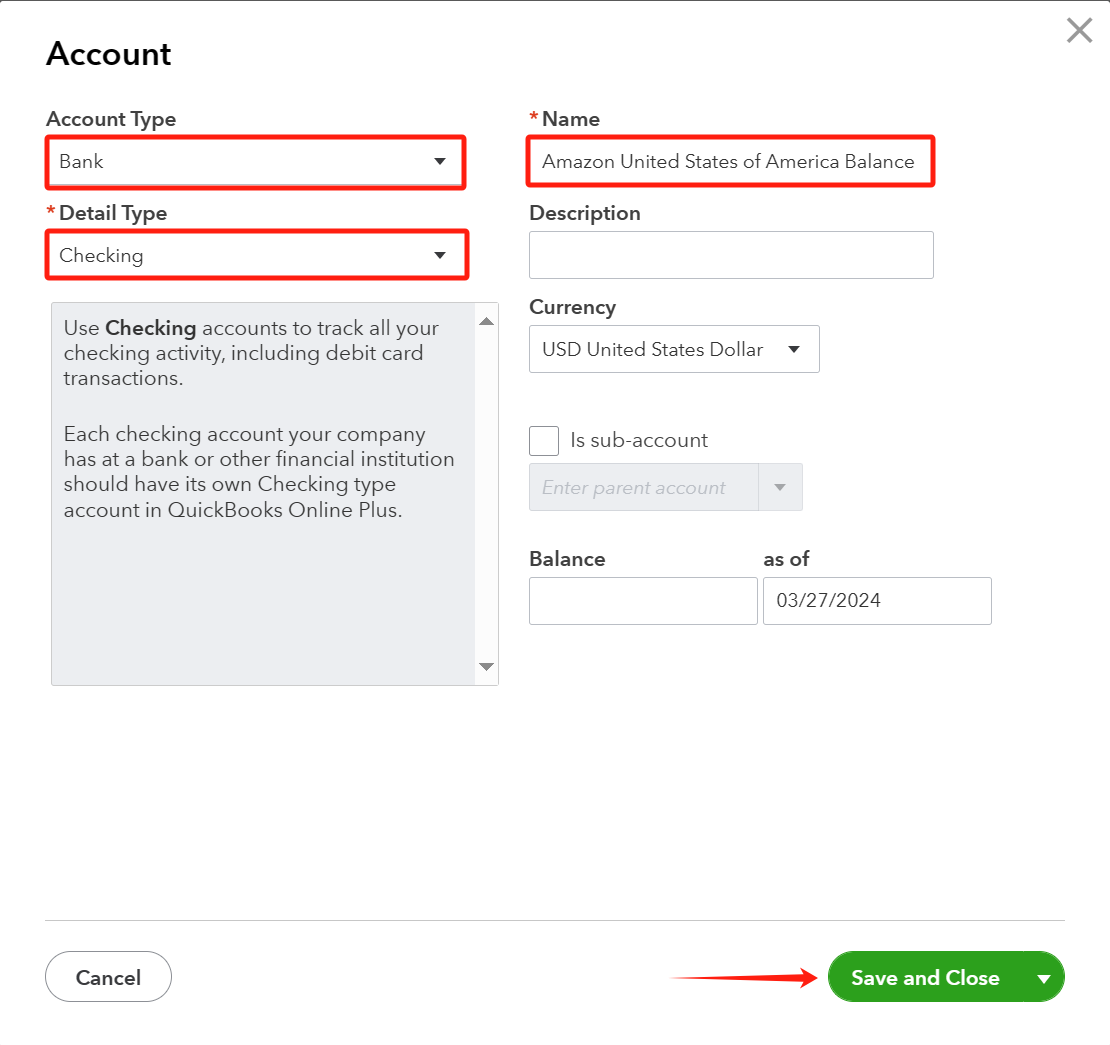

Amazon holds your money for every settlement period and pays you out at the end of the period. Even though the money hasn't been transferred into your own business bank account yet, this money is still technically yours, and we need to keep track of it in an Amazon Balance "Holding" Account.

Each marketplace in Amazon holds your money and pays out separately on a different schedule. Therefore, if you sell in different Amazon marketplaces, you will need to create separate "holding" accounts. I recommend you name it "Amazon United States of America Balance" if it's the US market. Likewise for other marketplaces, I recommend you name it "Amazon Canada Balance" for the Canadian market.

This way, if you look at the Balance Sheet, you will see the total balance that your business owns, including the amount stored in your bank account and the amount stored with Amazon waiting to be transferred to your bank account.

Next, we need to create income accounts for every type of income that the business generates on Amazon. We also need to generate a NonInventory Item of the same name, so that an item is attached on the sales receipt in QuickBooks. This way, when we look at the profit and loss report, you will see exactly where the income comes from.